DOT (Polkadot) can be staked

One that can be staked is Polkadot (Polkadot/DOT).

Polkadot is a native token for the ETH side layer chain, developed by Ethereum co-founder Gavin Wood.

Polkadot, also one of ETH’s sidechain layers, is one of the so-called ETH related stocks whose prices have skyrocketed in 2021 due to the expansion of DeFi and NFT areas.

It is also a token with a very promising future, with the possibility of further price increases depending on future updates.

The advantages of staking such Polkadot include

- Just leave your Polkadot with a validator and you will be rewarded with a Polkadot.

- Holding a certain amount of Polkadot may give you airdrops, etc.

- You can participate in Polkadot’s para-chain auctions.

and others.

In this article, we will discuss Polkadot’s staking method, which is highly promising, but first, let us summarize the conclusions of this article.

- Polkadot’s staking yield/interest rate (APY) is relatively high at 14

- For Polkadot staking, we recommend BINANCE or Polkadot{.js}.

- BINANCE is the best place to buy Polkadot!

To start staking, you must purchase a Polkadot.

Among the crypto changes, BINANCE is the best place to buy DOT.

Because,

- BINANCE is one of the largest exchanges in the world

- Achievement of overwhelmingly low remittance fees

- With BINANCE, staking is possible by simply owning Solana

If you want to buy Solana, buy BINANCE first.

What is the DOT (Polkadot) ?

Polkadot (DOT) is the native token of the Polkadot network, founded by Gavin Wood, co-founder of ETH (Ethereum), the second largest market.

The Polkadot network was launched in May 2020, and more than 200 projects have already been built on the Polkadot network.

Polkadot is characterized by two key features: interoperability and parachaining.

Interoperability is a technology that allows different blockchains to interoperate by connecting them to each other.

Polkadot’s interoperability allows for the transfer of all types of data and assets across other blockchains, not just any token.

Parachain is a technology that increases transaction processing speed by dividing transactions among multiple parallel blockchains.

Blockchain has “scalability,” which is the delay in processing due to the large number of transactions. Polkadot’s validators validate multiple chains, which increases processing speed and solves scalability.

Interest rates/yields for DOT staking

| Staking Method | expected yield | Recommendation |

| Regular staking and Polkadot{js} staking in BINANCE |

10% to 14 | ★★★★☆ |

DOT staking rates/yields range from about 10% to 14%.

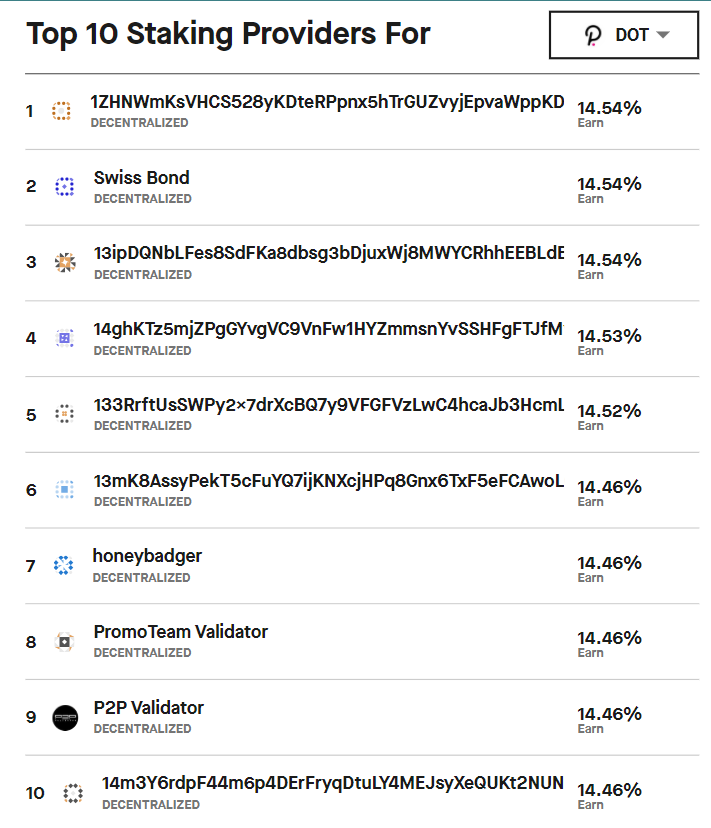

According to Staking Rewards, as of January 2022, Polkadot’s staking yields an interest rate of approximately 14%.

Also, according to Ledger‘s Polkadot staking page, which offers staking for several brands, Polkadot’s staking rate is listed at approximately 10%.

The current annual yield on Polkadot is around 10%, minus the validators’ commission rate.

Citation: Ledger

Polkadot’s high future potential could lead to higher prices.

Therefore, we recommend staking Polkadot early.

There are two methods of staking DOT

In addition, there are two ways of staking Polkadot

- BINANCE regular staking (for beginners)

- Staking with Polkadot{.js} (for intermediate and above)

The major exchange BINANCE offers Polkadot’s staking service for regular staking. Staking yields vary depending on the lock period (the length of time you are staking). Please note that it is not possible to choose the validator to which the staking is to be made.

On the other hand, there is also staking in Polkadot{.js}, the official Polkadot wallet.

Staking with “Polkadot{.js}” requires more work, such as preparing your own wallet, but you can choose the validator (verifier) to which you want to stake your money.

| Staking Method | interest | Validator’s Choice |

| BINANCE’s regular staking | 11% to 16 | without |

| Staking with Polkadot{.js} | 14%. | existence (at the present moment) |

If you want to see Polkadot staking for the first time, we recommend that you start with regular staking at BINANCE.

With BINANCE’s periodic staking, simply lock (deposit) your Polkadot in BINANCE.

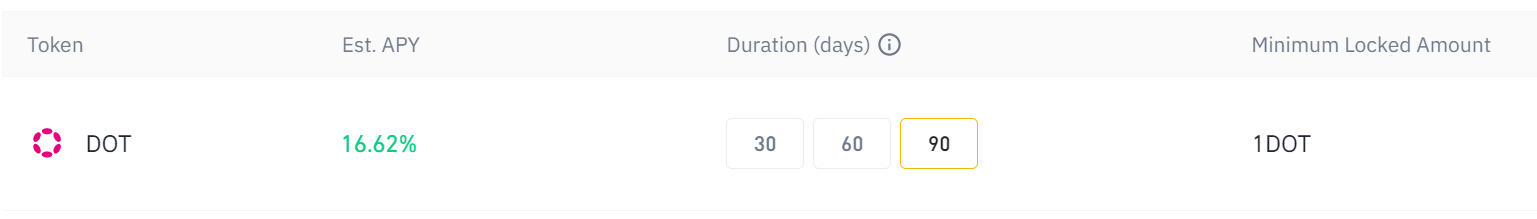

BINANCE’s APY is from 11% to 16%

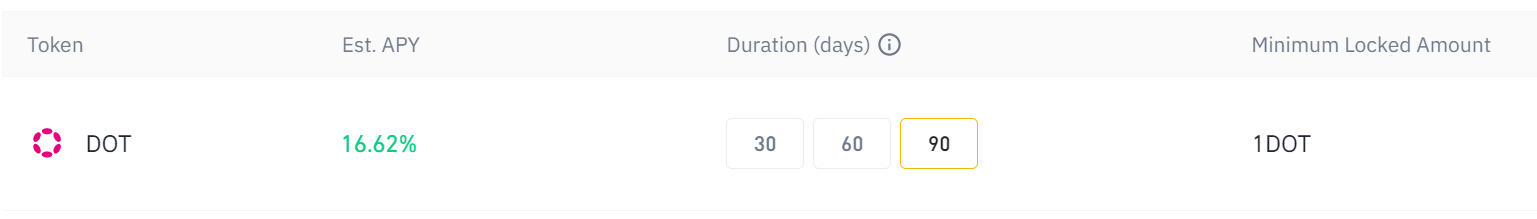

The yield on Polkadot’s fixed-term staking in BINANCE varies with the lock period (30, 60, or 90 days).

The longer the lock period, the higher the yield.

| lock period | interest |

| 30 days | 11%. |

| 60 days | 14%. |

| 90 days | 16% |

In addition, the minimum staking (locking) amount is 1 DOT.

If you are going to try staking, start with BINANCE’s regular staking.

Compared to Polkadot{.js}, it has the advantage of eliminating the transfer procedure from Binance.

However, there are the following disadvantages

- Binance’s regular staking is often lower APY.

- No staking if sold out.

Click here to register for BINANCE.

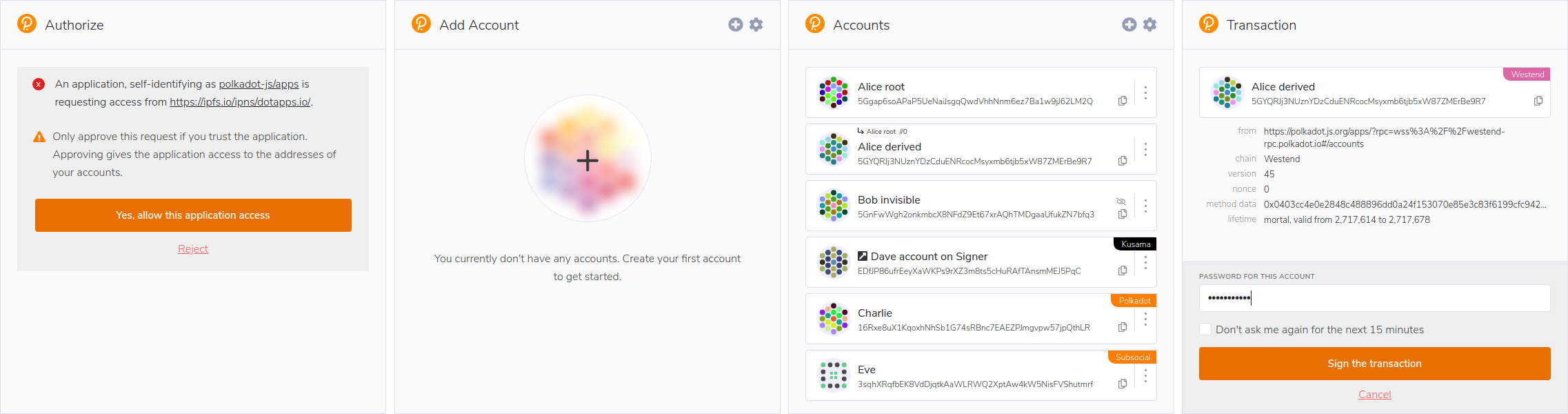

How to Stake DOT with Polkadot{.js}

Staking is also possible with Polkadot{.js}, the official Polkadot wallet.

The procedure for staking with Polkadot{.js} is the following 4 steps.

- Add polkadot{.js} Chrome extension and create an account

- Buy DOT (Polkadot) on Binance

- Polkadot remittance to Polkadot{.js}

- Select a validator and start staking

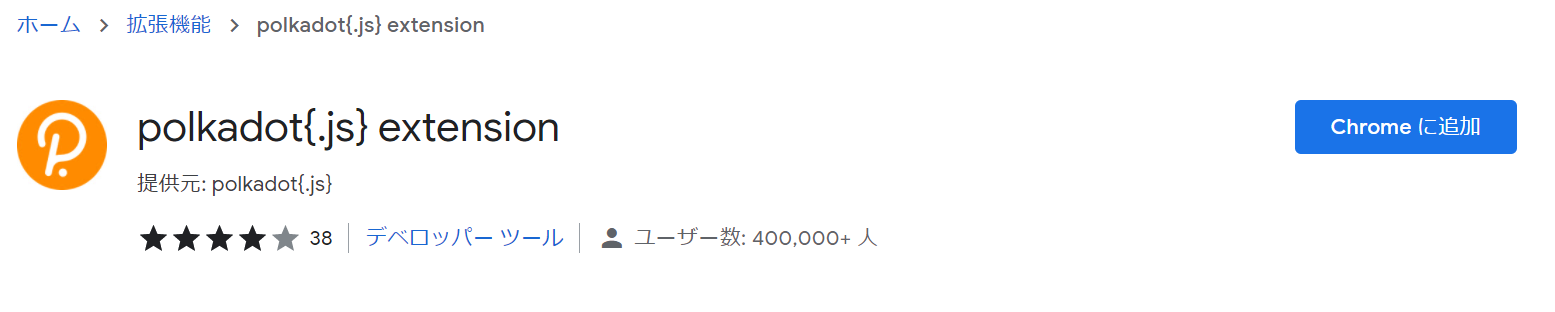

Add polkadot{.js} Chrome extension and create an account

polkadot{.js} is the official Polkadot digital wallet that anyone can use for free.

It is easily available as a Chrome extension, so download it first.

Once the download is complete, the next step is to create an account.

Click on the Extensions tab in the upper right corner of Chrome and launch polkadot{.js}.

After launching, set your account ID and password to complete account creation.

Transfer purchased DOT (Polkadot) to Polkadot{.js}

After purchasing DOT (Polkadot) , now transfer it to Polkadot{.js}.

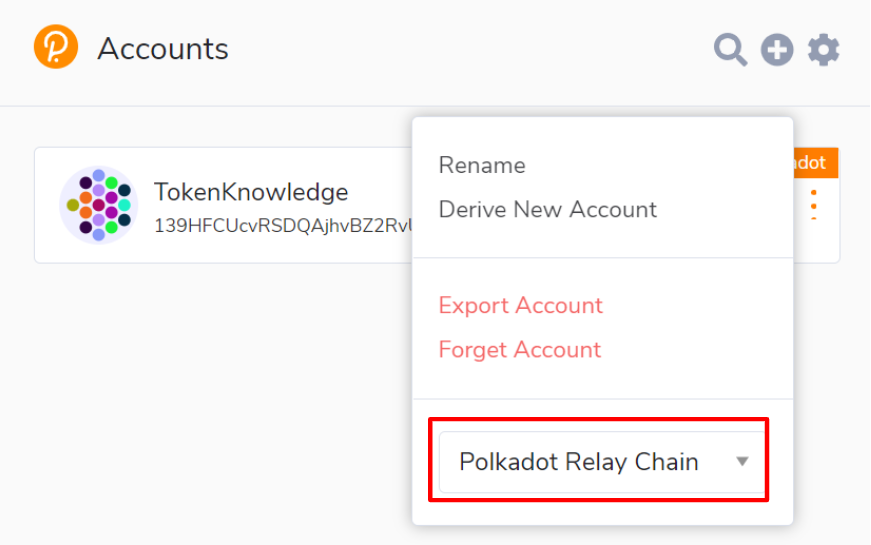

After logging into Polkadot{.js}, open the configuration page and change the network to “Polkadot Relay Chain”.

Be sure to change the address for other network addresses, as they may not be remitted correctly.

After changing the network to Polkadot Relay Chain, copy the address, and request the money transfer.

Select a validator and start staking

Once you have successfully deposited money into polkadot{.js}, set up the staking.

The procedure for staking in Polkadot’s network is as follows

- Go to Polkadot-JS main page

- Tap the “Staking” link under the “Network” tab at the top

- Tap “Account Actions”

- Click on the “+NOMINATOR button” (upper right)

- Select the Stash account and the Controller account, then select the amount to be staked and the destination of the reward

- Select the validator you wish to stake from the list of validators

- Enter your account password, tap “Sign and Submit” and you’re done!

Tips for choosing a Polkadot validator

When staking with polkadot{.js}, you must choose a validator.

A validator is a depository for tokens that are staked during the lock period.

Here are three points to consider when choosing a validator, as presented on Polkadot’s official website.

- Select multiple validators

- Beware of “most profitable” optional features

- Pay attention to commissions

Select multiple validators

Polkadot staking allows staking to be distributed across multiple validators.

In staking, where yields fluctuate in real time, it is better to diversify across multiple validators, as inactivity in staking on one validator may result in a loss of rewards (compensation).

Polkadot allows a maximum of 16 validators to be selected, but it is recommended that staking be spread over 2~5 validators.

Beware of “most profitable” optional features

Image source: Polkadot, “How do I know which validators to choose?

When selecting validators, turn on the “Most Profitable” tab to sort the validators in order of yield.

At first glance, it may seem easier to select a validator with a higher yield, but it is not recommended to make a decision based solely on the yield at the time of confirmation, because the yield of a validator fluctuates in real time.

Rather, he states that one should select a reliable validator by checking the high stakes and other factors of that validator.

Pay attention to commissions

When choosing a validator, pay attention to commissions.

The commission is the fee that the validator collects from the rewards (compensation) of us holders who deposit the DOT. If this commission is 100%, no reward is given to the holder.

So, should we choose a validator with low commissions? Usually, low commissions tend to make the validator rather less trustworthy, since the validator may neglect infrastructure development in order to get paid more.

Conversely, validators with higher commissions tend to be more reliable, and the official website recommends selecting validators with higher commissions.

If reliability is high, it is usually recommended to choose a validator with a higher fee.

Ultimately, commissions have a very small impact on compensation.

Quoted in Polkadot, “How do I know which validators to choose?

Image source: Polkadot, “How do I know which validators to choose?

Note that for validator commissions, the “No communication over 20%” button can be enabled to hide validators whose commissions exceed 20%.

How to Stake DOT on Binance

Staking Polkadot with BINANCE’s regular staking is easy.

The specific procedure involves the following four steps

- Open a BINANCE account

- Buy Polkadot (DOT) on Binance

- Staking the DOT with regular staking of BINANCE

Open a BINANCE account

First, open a BINANCE account.

Once you have opened a BINANCE account, complete STEP 1 of the identity verification process in order to begin trading.

STEP 1.

- passport

- driver’s license

Identification documents such as the following are acceptable.

Identity verification is available up to STEP2, where a certificate of residence is submitted, but there is no problem with only STEP1.

Click here to register for BINANCE.

Buy DOT on Binance

Next, purchase Polkadot (DOT) on a exchange.

Among the crypto changes, BINANCE is the best place to buy Solana.

Because,

- BINANCE is one of the largest exchanges in the world

- Achievement of overwhelmingly low remittance fees

- With BINANCE, staking is possible by simply owning Solana

If you want to buy Solana, buy BINANCE first.

Staking the DOT with regular staking of BINANCE

Once the DOT (Polkadot) has been successfully deposited in BINANCE, go to BINANCE’s Periodic Staking page.

Please note that the minimum holding for Polkadot’s regular staking is 1 DOT.

The following is how to do regular staking in the BINANCE application.

- Tap the bottom right corner of the app → Tap “Earnings” → Tap “Earn Products

- Tap “Subscribe” under Periodic Staking

- Select lock period (30 days, 60 days, or 90 days)

- Enter the amount of DOT to be staked and tap “Subscribe”.

Staking rewards will be reflected on the application from the following day.

How to View DOT Staking Rewards/Rewards in BINANCE

Staking rewards (rewards) for staking in BINANCE are given daily.

The DOT (Polkadot) granted will be reflected as a balance in your wallet.

To check your rewards, follow these steps

- Start BINANCE, tap “Wallet” in the lower right corner, then “Earnings”, then DOT (Polkadot)

↓↓ - Reward the number of tokens held shown under “Accumulated Interest.”

The DOT history shows that DOTs are granted daily.

Recommended staking issues other than DOT

Finally, here are some recommended staking brands other than Polkadot.

Yields on the Polkadot presented here range from about 10% to 14%.

ATOM and AVAX are expected to yield as much as Polkadot.

Also, if you expect higher yields than Cosmos, BNB, or Polkadot, we recommend the CAKE/AVAX pair, which can be staked with pancake swaps on the DEX (decentralized exchange).

The yield is approximately 40%, which is outstandingly high among staking issues.

Remember, however, that the higher the expected yield, the higher the risk may be.

Summary of DOT Staking

In this article, we will discuss Polkadot’s staking method, which is highly promising, but first, let us summarize the conclusions of this article.

- DOT’s staking yield/interest rate (APY) is relatively high at 14%.

- BINANCE or Polkadot{.js} is recommended for staking DOT

- BINANCE is the best place to buy DOT.

If you’re ready to start Polkadot staking, I recommend you open a BINANCE account first!

If you are also interested in staking other tokens, please see here.